“No matter what a waste one has made of one’s life, it is ever possible to find some path to redemption, however partial.”

—Charles Frazier, Cold Mountain

The life of an Independent Financial Professional (IFP) is a life of many imperfections, failures, and flaws. Wait, did you think I was describing the IFP? No, I was portraying the clients! Of course IFPs make mistakes and have shortcomings, but so do clients.

Thankfully though, perfection is not a prerequisite for progress. Something desperately needed by both advisors and clients in the financial journey, is grace and redemption.

Stories that are redemptive in nature progress from negative beginnings to positive endings. That sounds very much like what we hope will be every person’s financial journey.

Redemption

In Independent Financial Services, “redemption” refers to the repayment of any fixed-income security at or before the asset’s maturity date. Examples: Bonds, Certificates of Deposit (CDs), Treasury Notes (T-notes), and Preferred Shares. In addition, Mutual Fund investors can request redemptions for all or part of their shares.

Another use of the word redemption is in the context of coupons and gift cards, which we redeem at restaurants and grocery stores for products and services.

Frankly, “redemption” is one of my favorite words. How do we apply such a noble idea like redemption to our real lives? Consider:

- “In a redemption sequence, a demonstrably ‘bad’ or emotionally negative event or circumstance leads to a demonstrably ‘good’ or emotionally positive outcome.”1

- Redemption is the story about someone going through trials and becoming a better person.

- An individual redemption story happens when past mistakes are redeemed through deliberate actions to achieve the story’s resolution.

In order to apply the power of redemption to our clients we need to look carefully at a few words contained in the above list:

- “Leads to”

- “Becoming”

- “Through deliberate actions”

Leads To

In our daily lives we tend to make innumerable financial decisions, and the choices we make can have far-reaching consequences. When we make the right financial decisions, the results can lead to increased savings, growing investment portfolios, and steady wealth accumulation.

Conversely, when we make negative or uninformed financial decisions, we can experience serious personal repercussions, putting our individual and family savings, assets, credit score, retirement accounts, and access to future financial services at risk. Some people fail by pursuing “get rich quick” schemes.

An ancient proverb says: “Wealth gained hastily will dwindle, but whoever gathers little by little will increase it.”2

Poor financial planning may not cost us in the near term but may lead to us bearing a heavy price in the future.

In the short term, a wrong decision might lead to setbacks, such as financial loss, missed opportunities, or unnecessary stress and frustration. Wrong decisions can waste time, money, effort, and resources that could have been allocated more effectively.

Examples:

- Overspending

- Too much accumulated debt

- Not establishing an emergency fund

- Insufficient funds set aside for retirement

- Overly aggressive investment risks

- Failure to acquire proper amounts of Life Insurance

Point: A proactive IFP will attempt to connect with people in the early stages of their careers in order to lead them to right decisions. And yet every IFP will meet people still reeling from past decisions. Therefore, the IFP has a two-fold objective: first, lead the uninitiated in the right direction; and second, lead the financially-burdened client to brighter light and more positive status.

Becoming

“So be sure when you step,

Step with care and great tact.

And remember that life’s

A Great Balancing Act.

And will you succeed?

Yes! You will, indeed!

(98 and ¾ percent guaranteed).”

—Dr. Seuss, Oh, the Places You’ll Go!

Every person develops a sense of their own life purpose, and this in turn determines personal definitions of success. Financial success looks different for everyone.

Financial failure surprisingly looks pretty much the same regardless of who achieves it. The path to redemption from past failures, on the other hand, looks quite different for each of us.

Financial success is not determined by the amount of money we earn, or how much wealth we accumulate; but rather, how comfortable and in control of our financial situation we feel (and how much we contribute to the needs of others).

There are several redeeming elements to becoming comfortable, confident, and charitable in our financial lives, including:

- Establishing S.M.A.R.T. goals. What do we want to do with our money? (Specific, Measurable, Attainable, Reasonable, and Time-bound)

- Make a list (debts, bills, budget, savings, investments, etc.) and be honest with ourselves about where we stand, money-wise.

- Create a spending and savings plan with specific strategies to make our budget actually work.

- Develop and stay disciplined to fulfill a comprehensive plan designed to reduce debt.

- Wisely, and selectively choose charitable opportunities.

- Seek advice and do research. We all need a seasoned, knowledgeable, and relatable IFP to come alongside us in our journey of becoming.

- Invest diversely.

- Contribute methodically.

- Insure our lives, incomes, and assets prudently.

A redemption arc in a story requires substantial character development. Redemptive actions must carry sufficient weight in order to cancel prior mistakes. Becoming successful requires meaningful change in behavior.

Point: Becoming is not something that just happens unless the goal is to fail. Becoming successful requires diligence and preparation.

Deliberate Actions

“The way to get started is to quit talking and begin doing.”—Walt Disney

People who are committed say, “I’ll do it!”

People who want to leave a little wriggle room, say something like “Okay, I’ll try and do it…”

When someone tells you, “We must try and get together sometime,” they mean something like, “I really do not care if I see you again!”

“Try” invariably creates doubt and suggests that it is unlikely that success will be achieved.

A great secret to the redemptive story arc is replacing “try” with “will.”

When we say, “I will,” we are saying, “I am committed.”

Yoda says, “NO! Try not. Do, or do not, there is no try.”

In my faith tradition, redemption is only possible after repentance. Repentance means doing a 180 percent turn. The Greek word is metanoia and means, “changing your mind, turning around.” To experience a redemptive arc in a storyline that involves previous financial mistakes and misjudgments requires repentance—a change in mind.

- Here are some deliberate actions an IFP can recommend to people experiencing the consequences of past failures:

- Distinguish between identity and position. Someone who has made mistakes is not a failure. The consequences of poor decisions are often unavoidable, but that only means we are dealing with failure, not that we are not failures.

- Learn from previous mistakes and misjudgments or unproductive behavior. Experience is sometimes a harsh instructor.

- Choose to believe that failure is temporary. Remember the words of Winston Churchill: “Success is not final; failure is not fatal: it is the courage to continue that counts.”

- Adjust expectations. Redemption does not result from a random act of restitution. In a pure redemption arc, the protagonist will undergo multiple trials or encounter many people who inspire nonnegotiable moral shifts.

- Seek forgiveness. When we make unwise financial decisions, we inherently impact the people in our lives who depend on us. Like repentance, forgiveness must precede redemption. This includes forgiving ourselves.

- Reality check. We must remind ourselves that humans are inherently flawed. We all do things that are wrong, but we also know that people are capable of change.

Point: Without accepting responsibility we cannot learn from our failures; however, people cannot believe they are fundamentally a failure and expect to move forward at the same time. We must forget the negative emotions of setbacks and press forward.

Summary

Financial miscues, bad decisions, and negative habits can impact our lives greatly. The consequences can lead to legal issues (bankruptcy), bear social implications (broken trust and destroyed relationships), and have mental ramifications (anxiety, stress, and doubts).

Good news! We can redeem past bad financial decisions. This will require determination and action. But first we might have to:

- Seek forgiveness for the strain we have placed on key relationships with our spouse, and even with children. Money failures can be a distraction, and sap valuable time and emotional energy from other pressing concerns.

- Look our circumstances dead in the face and identify the anxiety we feel about being unable to pay our bills, our inability to save, and our fears and worries about the future. In addition we may not be as generous to others as we want.

- Remember that there are a lot of things outside our control. We cannot control the economy, inflation, geopolitical events, politics, or many other things.

- Deeply contemplate our money-related fears and ask ourselves if our worry reveals something about what we are trusting in. (Alternatively, if we are doing okay financially, we can be tempted to view money as our primary source of security.)

Definite Actions to Redeem Past Financial Blunders

- Reduce our debt by first creating a list of our debts, looking at minimum payments, prioritizing imputed interest rates, and comparing outstanding total loan balances. With these factors in hand we can develop a debt repayment strategy that works within our budget. This may include a loan consolidation plan.

- Regain ground lost in funding our retirement savings plan. The best time to start saving is now. We can gradually increase our contributions by a percentage or two every year.

- Dial back on nonessential spending.

- Increase our income by freelancing or starting a side business in order to supplement present income.

If you are an Independent Financial Professional, you will encounter people who feel shame, regret, or resentment. These feelings bubble up to the surface whenever they log into their bank account. It’s important for you to remind them that they are not alone. We all make mistakes in life. We’re only human!

As an IFP you can play a redemptive role in their lives! You can begin by giving them a clearer perspective. You can help them make a plan of action to help mitigate the damage. You can help them learn from past mistakes and work towards a brighter future.

A great redemptive arc always leads to long lasting improvement and renewal.

“Leadership is about making others better as a result of your presence and making sure that impact lasts in your absence.”—Sheryl Sandberg

Footnotes:

1. https://www.sesp.northwestern.edu/docs/RedemptionCodingSch.pdf.

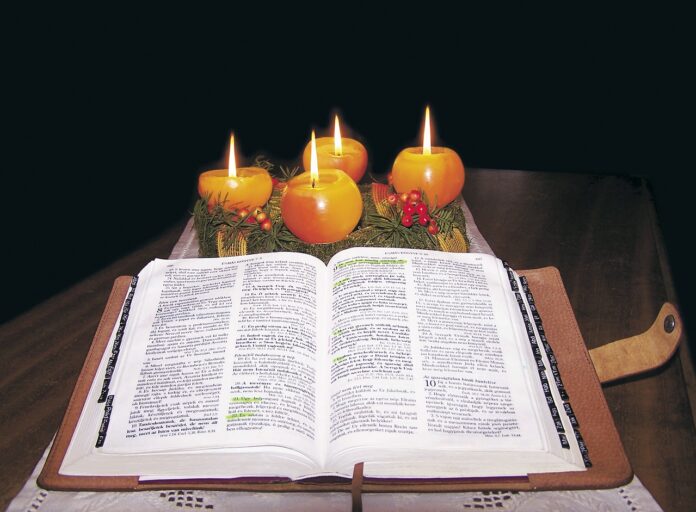

2. Proverbs 13:11, The Holy Bible, English Standard Version. ESV® Text Edition: 2016. Copyright© 2001.