The pandemic challenged long term care insurers in several respects. This article describes some of the ways that insurers made exceptions to help policyholders during the pandemic, underwriting practices they chose and the potential impact on pricing.

Claims processing during the Pandemic

Some long term care insurance companies offered outstanding accommodations to support claimants and their families during our unprecedented pandemic. Despite the losses which insurers incur on LTCI policies and their reluctance to set precedents which could come back to haunt them, some insurers belied the theory that they focus on how to avoid paying claims.

Here is a partial list of actions that some LTCI companies’ claims departments took in order to serve their clients better.

- Paid for home care when people moved from facilities to home care (even if the policy did not cover home care), perhaps done by temporarily broadening what could be covered under an alternative plan of care provision or with an extracontractual letter that included a statement of Reservation of Rights to avoid setting precedent or a claim of waiver or estoppel.

- Paid for care by family members, even for policies that did not cover the cost for family members or had lower limits for such care.

- Extended bed reservation periods (sometimes even when bed reservation was not included in the policy).

- Extended the period for satisfying the elimination period (e.g., 90 days in a 360-day period).

- Did not enforce a second elimination period where there was a discontinuation, then resumption, of benefits.

- Continued to waive premium for claimants who stopped receiving covered services, contrary to policy provisions.

- Used video or telephone for claimant assessments.

- Benefit Eligibility Assessments became more varied and customized.

- Recertification procedures were loosened, particularly for those not expected to recover, largely because face-to-face recertification was not possible while facilities were closed to outsiders.

- Relied more on electronic medical records, even if not as comprehensive as desired.

- Repatriated services that had been shipped overseas.

- At the same time, insurers were investing in and rolling out software to facilitate the claims process.

a) Added authentication to increase security and permit enhanced transactions.

b) Permitted claimants’ representatives to access and provide information electronically at any time.

c) Smart forms to garner the necessary information while avoiding questions that are irrelevant to the situation.

d) Moved uploaded documents directly to claims processing queues.

e) Created automated follow-ups for claimants to remind them of outstanding requirements and due dates and also automated follow-ups for claims staff to perform various activities.

f) Electronic payment to claimants’ bank accounts.

g) More electronic reporting systems for providers, including electronic visit verification.

Underwriting during the Pandemic

As part of its annual LTCI Survey published in Broker World magazine in the July and August issues, Milliman asked some questions about underwriting practices during the pandemic.

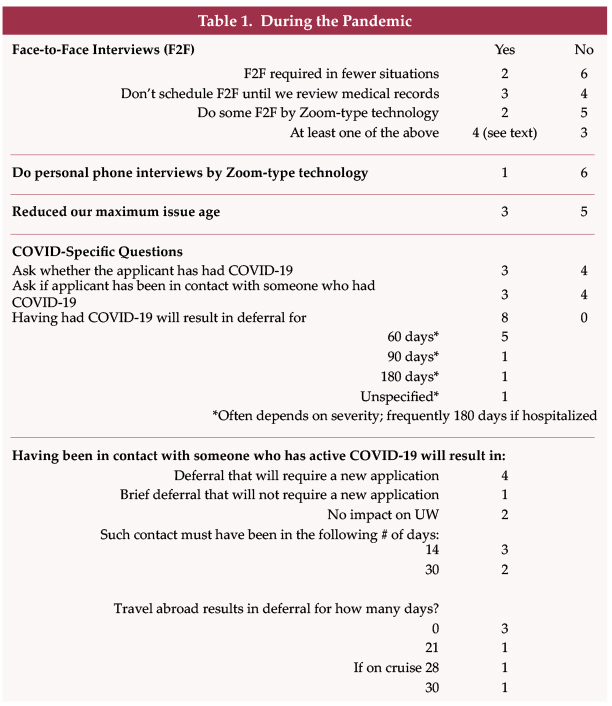

Four of eight insurers indicated a variance in face-to-face interview (F2F) practices, in one or another of the ways documented in Table 1.

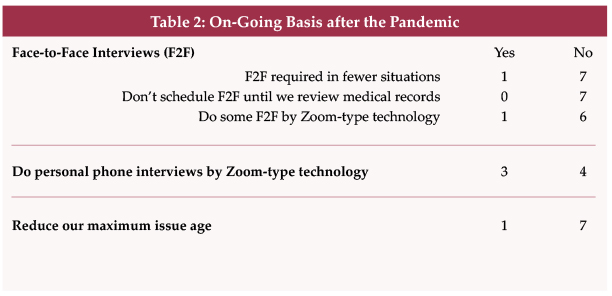

Two insurers required face-to-face interviews in fewer situations and one of them expects to continue to have fewer face-to-face interview requirements.

Three insurers now hold off on scheduling a face-to-face interview until medical records have been reviewed.

Two insurers did F2F interviews by Zoom and one of them expects to continue to do so post-pandemic. Another insurer indicated that they might consider this change in the future “dependent on reinsurer’s willingness to accept this in place of traditional face-to-face interviews.”

Only one of seven insurers responded that they did personal phone interviews by Zoom. Apparently, as phone interviews were not done face-to-face, modification was not necessary. However, three insurers expect to do such interviews by Zoom in the future.

Three insurers reduced their maximum issue age. We are aware of one stand-alone LTCI carrier which reduced its maximum issue age from 79 to 65 on April 16, 2020, because of difficulties completing face-to-face interviews, but these restrictions were removed in 30 jurisdictions by June 14 and in others as stay-at-home orders were rescinded. One insurer expects the reduction in maximum issue age to continue post-pandemic.

Linked-benefit insurers were more likely than stand-alone long term care insurers to reduce their maximum issue age, not only because of the pandemic but also because of low investment yields. Of the five linked-benefit insurers for which we have information, four cut off sales above age 70 and the fifth discontinued, above age 70, recurring premium, some designs and substandard sales but continued to accept single premiums.

Three of seven carriers ask the applicant whether he/she has had COVID-19 or been in contact with someone who has COVID-19. Based on the comments of the four insurers who reported not asking these questions, it appears that some companies relied on medical records, symptoms, and/or a catch-all “not otherwise disclosed” question to expose having (had) COVID-19. At least two insurers are monitoring the longer-term impact of COVID-19 before deciding whether to refile their applications with COVID-19 (or related) questions.

People who have had COVID-19 are deferred 60 to 180 days depending on the insurer, the CDC’s recommended quarantine period and on hospitalization, severity, residual impact, and potential impact on existing comorbidities. As noted in Table 1, some insurers routinely defer more than 60 days.

Five of seven insurers indicated that having been in contact with someone with COVID-19 will result in deferral. Generally, the contact period and deferral period were the same, either 14 or 30 days. For example, if someone was in contact with a person who had COVID-19 in the past 14 days, they would be deferred for 14 days. One insurer responded that if someone has been in contact, within the past 14 days, with a person who had COVID-19, the application would be deferred for 30 days, noting that the 30 days is measured from recovery.

Three insurers reported different deferral periods for traveling outside the USA: 21 days; 30 days; or 28 days if it was a cruise. Three insurers had no deferral because of COVID-19 concerns over foreign travel.

In addition to the above questions, when asked to look into the impact of the pandemic in the future, one insurer predicted tighter underwriting, one predicted increased prices (five predicted no change in pricing), and one predicted a change in policy design to reflect a shift from facility to home care and care by family members.

Impact on the Future Cost of LTCI

LTCI companies saved money during the pandemic. Clients, particularly in nursing homes, died. Non-claimant insureds who might have become claimants in the near future also died. Claimants and potential claimants vacated facilities, replacing facility claims with generally less-costly home care claims and even less expensive family caregiving. According to a study3 by FitchRatings, the LTCI industry improved from a $2.3 billion loss in 2019 to a $241 million profit in 2020. The factors mentioned in this paragraph contributed to the improved results as well as other factors such as price increases and perhaps less reserve strengthening.

As noted above, most insurers do not envision an increase in the unit price of LTCI. However, the impact of COVID-19 on future claims is unknown. Are COVID-19 survivors more vulnerable to needing long term care? Is there a residual cognitive or physical impact? What will be the long-term impact of inability to address chronic or other conditions due to skipped doctors’ and physical therapy appointments, postponed surgery, or psychological and physical reaction to disrupted routines and relationships?

It will also be interesting to see how much “salvage” there is in LTCI policies in the future. Insurer pricing reflects that claimants do not necessarily use their full daily or monthly maximum. To the degree that insurers anticipate such wastage in their pricing, the resultant premium goes down.

As explained below, we anticipate that the cost of care in each major type of venue (nursing home (NH), assisted living facility (ALF), home care (HC)) will increase. Hence, we expect the wastage percentage factor for each venue to reduce.

A lower wastage percentage assumption would result in a small increase in LTCI premiums. However, even with a lower wastage factor for each of the three mentioned venues, the average wastage ratio could rise because of a shift from facility care to home care.

Because the cost of care is likely to increase, consumers may feel a need for a higher LTCI monthly maximum. If the initial maximum monthly benefit is tied to the cost of a nursing home or assisted living facility, applicants will experience higher premiums even if the unit price (e.g., per $10 of initial daily benefit) remains unchanged.

However, that could be offset by applicants who shift how they determine the desired initial maximum monthly benefit. To the degree that they decide an initial monthly maximum that would cover ALF cost instead of NH cost or the likely cost of home care rather than facility care, they may accept more risk in lieu of buying more insurance.

The cost of facility care is likely to increase because facilities may incur higher costs due to physical and procedural modifications as a result of the pandemic and a likely need for a higher staff-to-resident ratio. Furthermore, occupancy rates slumped significantly during the pandemic and people needing rehab avoided facilities. If lower overall occupancy and/or a loss of rehab business continues, facilities seem likely to have to raise prices to cover their overhead costs.

A December 2020 survey of nursing homes1 found that 65 percent were operating at a loss and another 25 percent were operating on a zero to three percent margin. Similarly, a survey2 found that 50 percent of assisted living facilities were operating at a loss, with 13 percent operating at zero to three percent profitability. The post-pandemic recovery will help (reducing overtime for example) but seems unlikely to fully restore their prior financial results. Therefore, facility prices may have to increase, and a significant number of facilities might close. A reduction in the number of facilities would improve the profitability of the remaining facilities but it might also reduce the pressure for competitive pricing.

Home care hourly costs are likely to increase for several reasons. Significantly increased demand will raise the cost of limited supply. Additional costs are for protective equipment similar to masks with a particle filter on them to prevent contagion, or of course, testing and training which could also contribute to higher prices. Other independent factors could also lead to higher prices, such as continuing consolidation and a higher minimum wage.

The ultimate impact of the pandemic won’t be known for a long-time, but it seems likely that there will be direct and indirect impacts. So far, the LTCI industry has weathered the pandemic well, keeping a focus on taking care of its claimants. That story deserves to be told.

References:

- Survey by the American Health Care Association and the National Center for Assisted Living, December 2020, https://www.ahcancal.org/News-and-Communications/Fact-Sheets/FactSheets/State-of-Nursing-Home-Industry_Dec2020.pdf.

- Survey by the National Center for Assisted Living, August 8-10, 2020, https://www.ahcancal.org/News-and-Communications/Fact-Sheets/FactSheets/Survey-AL-COVID-Costs.pdf.

- Jamie Tucker and David Gorak, FitchRatings; found at https://www.thinkadvisor.com/2021/04/07/covid-19-helped-long-term-care-insurers-in-2020-fitch/, which offered a link to https://www.fitchratings.com/research/insurance/long-term-care-insurance-dashboard-2020-improved-results-view-of-reserve-adequacy-unchanged-06-04-2021.