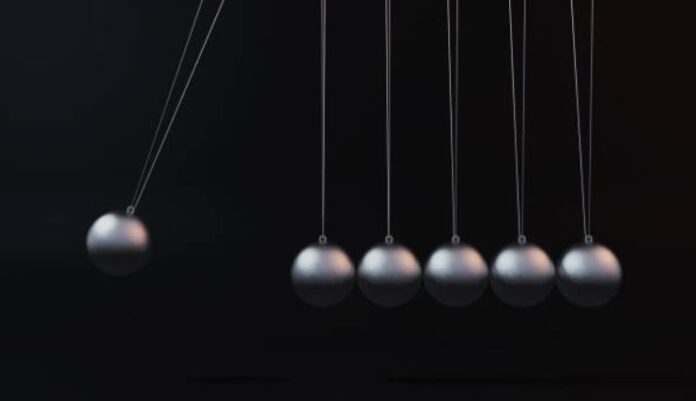

Are our times in transition, evolution, retrogression? Is our near term response to future caregiver preparedness potentially a new bull market renaissance or a bear market in full retreat? Is that noise off in the distance a stampede of hoofs or the thunder of crashing claws and paws? I only hear the faint squeak of a mechanical pendulum that must be approaching the apogee of it’s defined and limited arc and whose Newtonian necessity must be preparing to surge forward in the opposite direction. The sales reality of our chosen market is simply a burden we all carry. Our prognosis for the patient remains for most of us a fervent perhaps fanatical personal optimistic belief that the need is real and only insurance can make a difference.

We know something must ultimately provide the catalyst to effect change. The image that has the greatest resonance is the proverbial “what goes up, must come down” hypothesis. The human force and forethought necessary to balance and counterbalance a playground teeter-totter provides a much clearer model for consideration.

Just for fun let’s speculate on what might actually create bodies in motion:

- In 2034 older Americans will outnumber children.

- Every American will get caregiving on their boots as a caregiver or needing one themselves.

- Covid has left its mark on insurance. According to the recent 2020 LIMRA Insurance Barometer Study, one-third of consumers say they are more likely to buy life insurance. (Hopefully with a long term care planning option included.) The number rises to 48 percent when asked of Millennials. The desire to buy is at an all time high.

- Consumer awareness has become focused on the need to take action. Yet it remains clear that consumers need the greatest additional enlightenment concerning the true relationship between cost and value. The two greatest takeaways from this malevolent virus is the capriciousness of an early unexpected death and the desire to avoid an institutional setting for custodial care. I cannot imagine a greater invitation to explain the sound reasoning of providing life insurance protection that also provides the security of private care options.

- COVID has exposed the fragility of the inherent financial security of American families.

- COVID has galvanized the public’s perception of early, unprepared and tragic mortality. COVID has redefined the meaning and potential value proposition of staying at home.

- Although individual life sales have remained steady, life insurance sales overall have fallen slightly with the greatest reduction taking place in group sales as employer support was eroded by COVID. The group long term care planning market is limited by a cupboard that would have to be described as virtually bare. The insurance universe abhors a vacuum. Group product options will grow in the near term in response. Competition for employees always feeds that fire.

- It is technology and science that has risen to the occasion. This may actually be the location of that proverbial catalyst we have been searching to uncover. The mechanisms to maintain personal freedom at home have grown exponentially. Why not caregiver supervision with streaming Skype in every room? It seems a short step to caregiver stakeholder coordination managed by Zoom. I suspect this is where the renaissance necessary to reduce the costs of private care maintenance we have been missing may begin to emerge.

- Technology is also the answer to finally streamlining an underwriting process that can become an advocate for new sales not a perpetual impediment.

Pendulums must inevitably swing in the opposite direction, and teeter-totters require the least effort when the opposing forces are in balance. The global nightmare we have all endured may have actually helped create new momentum that can permanently effect change.

Other than that I have no opinion on the subject.