My wife, kids and I went to a Christmas party at a friend’s house this year where about eight other families were in attendance. As I was standing with a group of the “Dads” talking about sports, kids and other small talk, my friend Ryan, who was standing across the room, completely changed the topic and said, “Charlie, so how much do I need in 20 years when I am 65 years old to retire so that I get say $100,000 a year forever?” As you can imagine, the other Dads left the conversation like rats from a burning barn because they knew this was going to be a long conversation. After the dust settled, I responded to Ryan: “Well, it depends on a lot of different things-like what inflation will do between now and 20 years from now, what you will get from Social Security, if you have a pension, etc.” He then looked at me with disappointment like it was a complete non-answer. So, I took the opportunity to opine some more and said, “However, there is one thing that will affect the amount of money you need at retirement in order to get X dollars in income and it is your mindset about annuities.” With a sour look on his face he then asked me what I meant. So, I responded, “Well if you don’t believe in annuities and just have stocks and bonds and follow one of the withdrawal rules that some of the pundits have created, then you will likely need more money than if you otherwise believed in annuities.” Now this last statement confused him, as I knew it would. I also knew he would get a little defensive because he is a believer in the “do it yourself” stock and bond approach. I hear that many people decided to trade these via brokers similar to Stocktrades. So it would be worth learning more from them. So, I then asked him if I can demonstrate on a couple of napkins what I meant by that. He happily agreed. After all, it was he that asked the question in the first place!

Here is the rest of the conversation that I had with Ryan. However, I will now have this conversation with you, the reader, in the same manner, instead of narrating my Christmas party conversation.

Napkin Demonstrations for Ryan

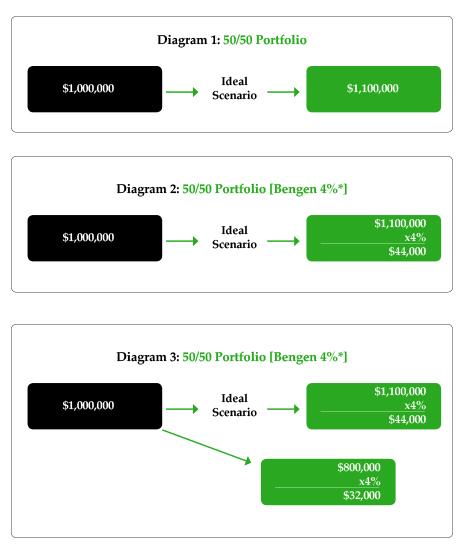

To demonstrate my point about annuities, let’s simplify this and say you are 63 years of age and you want to retire in two years at age 65. Let’s say that you have saved $1,000,000 in a stock/bond portfolio that you want to use to provide income in retirement. First, you have to know the different types of annuities and how they can help you. What would you expect that portfolio value to grow to between now and two years from now when you plan to retire? In other words, what is a not too aggressive and not too conservative growth rate we can assume on a 50/50 portfolio over the next two years? Let’s assume five percent per year that you “might” get on that portfolio. Again, keeping it simple and not including compounding, let’s say that means the portfolio will grow to $1,100,000. (See Diagram 1)

Now, at that point in time, you will retire and withdraw a certain amount from your portfolio. What percentage should we withdraw where we are confident it will last 30 years? Not an easy question, right?

The Bengen Four Percent Rule

In 1994 a CFP from California named William Bengen created what would become the “Gold Standard” of withdrawal rate rules of thumb. Bengen basically said that even though, over time, the market had averaged around 10 percent, that doesn’t mean that a client can “safely” withdraw 10 percent from their portfolios in the distribution years. So what William did is he back tested a 50 percent stock/50 percent bond portfolio over rolling periods of time starting in the 1920s. After the analysis was said and done, he said that consumers were “safe” by withdrawing four percent of their initial portfolio value per year adjusted for inflation thereafter. Obviously not 10 percent. By “safe” what he meant was that the four percent distributions were very unlikely to spend down a retirement portfolio before the end of a 30-year retirement. As a result of this study, securities reps, RIAs, IARs and do-it-yourselfers for over two decades have been living and dying by this rule.

However, in recent years the four percent rule has been brought into question as a result of the market volatility and low interest rates. Morningstar, for instance, released a study after the financial crisis that indicated 2.8 percent as the new WD rate. Regardless, let’s stick with four percent as our “rule of thumb” because the math still demonstrates my point.

That means that “assuming” the portfolio grows by five percent per year (not compounded) over the next two years and “assuming” that the four percent is in fact “safe,” you should be able to take $44,000 per year (adjusted for inflation) for the rest of your life. (See Diagram 2)

However, none of this is guaranteed! The portfolio could drop 20 percent; one could live 40 years in retirement, etc.

So, what happens if the portfolio drops by 20 percent over the next two years as opposed to our first example? $800,000 times four percent means that you are getting only $32,000 or a $12,000 pay cut relative to what you thought you were going to get. (See Diagram 3)

Unfortunately, our “ideal scenarios” and reality do not always match, as many folks retiring in 2008, 2009 and 2010 experienced.

Let’s look at a possible alternative.

Basic GLWB Explanation

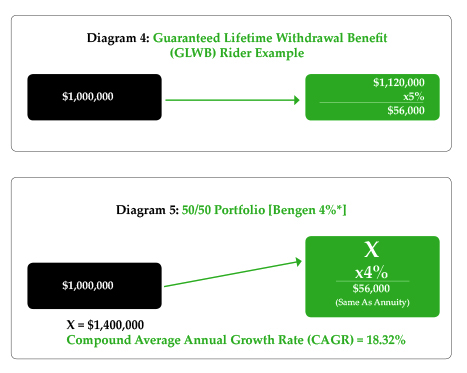

Many products and riders are different, but here is just a simplified example. What if I told you that the $1,000,000, from an income value standpoint, would not grow by five percent per year over the next two years, but would grow by a guaranteed six percent simple over the next two years-which would give us an income value of $1,120,000. Then, at that point in time, you would be able to withdraw not four percent, but five percent of that value for the rest of your life, guaranteed. By the way, did I mention the word guaranteed? That means that no ifs, no ands, no buts, you would be able to get $56,000 per year for the rest of your life. Versus the $44,000 that was the “ideal scenario” or $32,000 that was the “-20 percent scenario.” (See Diagram 4)

This is the value of annuities. In this example you’re guaranteed the growth on the income value of six percent, and then you’re guaranteed a payout factor which is five percent.

Explaining the Income Value/Benefit Base

Something that many agents have a hard time explaining is: “What is the income value?” Here is the way I explain it:

Let’s take an example of life insurance. Let’s say you have a cash value life insurance policy. There are two primary values with cash value life insurance-a small value and a big value. What is the small value? That is your cash value. That is essentially your money free and clear, outside of potentially surrender charges if it is universal life.

What is the big value? That is the death benefit. Well, for somebody to get that big value/death benefit, something must happen right? Somebody must die. That is the rule the insurance company has set for somebody to get the larger value that the insurance company is offering them.

Well, annuities also have a small value (accumulation value) and the big value (income value/benefit base). The small value is the client’s money-outside of surrender charges-and the income value is like life insurance’s death benefit in that you can get that dollar amount, but you must follow the rules the company sets forth. For annuities that rule is that you cannot take any more out than X percent per year.

Bullish on the Stock/Bond Markets?

Now, naturally one may be thinking, “Okay, but the assumption of the stock and bond portfolio of only five percent per year between now and retirement is very conservative. I think the market is going to go up much more than that.” So, I did some simple math in order to address those that may be more bullish than my previous example. I calculated, based off the four percent withdrawal rule, how much that stock and bond portfolio would have to grow over the next two years in order to generate the same income that the annuity is guaranteeing. The answer to that question is $1,400,000. (See Diagram 5)

That is a significant growth rate requirement regardless of how bullish you are. This represents a compound average growth rate of 18.32 percent per year between now and the point that my friend Ryan hits age 65. Again, one would have to be very bullish on the stock market to not recognize the value of that $56,000 lifetime guarantee.

At this point in the conversation with Ryan, I told him that effectively the $1 million annuity is guaranteeing a level of income that would require much more money if he just utilized the stock/bond portfolio and the four percent withdrawal rate. Note: These simplified examples were for merely demonstration purposes as I would not suggest Ryan put his entire $1 million retirement savings into an annuity. Furthermore, the four percent rule assumes income inflation adjustments which is beyond the scope of this simplified example.

“Seems to good to be true”

A question I commonly get is, “If some very smart people like Bengen and Morningstar say to not withdraw any more than four percent or 2.8 percent, then how can the insurance companies provide numbers this attractive? Seems too good to be true!” Here’s the story that I credit to one of the leading retirement researchers, Moshe Milevsky:

There were five 95-year-old ladies sitting around the table playing bingo. One of the 95-year-old ladies looked up and said “This is very boring! We have been doing this for 30 years and its time to try something new. Let’s all put $100 on the table right now and whoever is still alive a year from now will be able to split the entire $500 pool.” They all agreed it sounded like fun so they each threw $100 on the table. One year goes by and the mortality tables show us that there are only four of those 96-year-olds still alive. One of them unfortunately passed away. What does this mean? This means that each of those four 96-year-olds gets $125 at that point in time, which is $500 divided up four different ways. It wasn’t even invested in anything over that year but they each got a 25 percent return on their money!

Isn’t that amazing how each of those ladies were able to get significantly more money back than what they put in? That is effectively what annuity companies do. They take the clients’ premium, pool it together, and, for those that live to be a ripe old age, those retirees get what is called “longevity credits.” Those longevity credits were paid for by those that passed away early.

Nobody ever questions the logic of life insurance. They may question whether they need life insurance or not, but they never question the thought of risk pooling and hedging mortality. So why do they question the concept of annuities? Afterall, life insurance and annuities are merely the inverse of one another.

Reference:

*Bengen, William P. (October 1994). “Determining Withdrawal Rates Using Historical Data” (PDF). Journal of Financial Planning: 14–24.