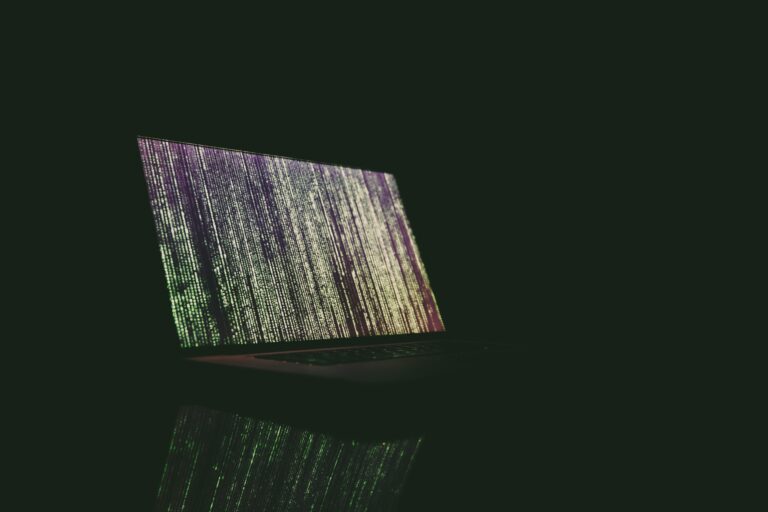

As technology evolves, so do the risks associated with cyber threats in the insurance industry. With the increasing digitization of processes and the growing volume of sensitive data, cybersecurity, and compliance have become paramount concerns for brokerage insurance firms and independent producers alike. It is imperative for industry professionals to prioritize cybersecurity measures to protect their clients, their businesses, and their reputation.

These statistics and examples provide evidence of the importance of cybersecurity and compliance in the broker insurance industry, emphasizing the need for proactive measures to mitigate risks and secure sensitive information.

Nine Reasons Why Cybersecurity and Compliance are Important

1) Ongoing Regulatory Compliance

- 79 percent of insurance executives believe that regulatory compliance is a top priority for their organizations. The future of regulatory compliance for the insurance industry requires leaders to find a balance between opportunity and obligation.1

- Example: In November, 2023, The NYDFS fined an Insurance company $1 million for violations of DFS’s Cybersecurity Regulation (23 NYCRR Part 500) stemming from a large-scale cybersecurity breach.2

2) Increase in Third-Party Vulnerabilities Now Used by Hackers as a Valid Entry Point

- The rise of software supply chain compromises was the root cause of 12 percent of breaches.3

- Example: The 2017 Equifax breach that exposed the personal information of millions of individuals was attributed to a vulnerability in a third-party software application.4

3) Outdated Systems and Infrastructure that Needs Patched

- The average time to identify and contain a data breach caused by an outdated system is 280 days.5

- Example: The WannaCry ransomware attack in 2017 exploited vulnerabilities in outdated systems, affecting thousands of organizations worldwide.6

4) AI and Advanced Technologies

- 75 percent of cybersecurity professionals have seen an increase in attacks over the past year, with 85 percent attributing it to threat actors weaponizing AI.7

- Example: Deepfake technology can create convincing fake videos of executives, potentially leading to social engineering attacks in the insurance industry. Instances of deepfake phishing and fraud surged by 3,000 percent in 2023.8

5) Liability Risk (Accountability across all roles)

- Global cybercrime damage costs will grow by 15 percent per year over the next two years, reaching $10.5 trillion USD annually by 2025, up from $3 trillion USD in 2015.9

- Example: The CEO of a large insurance company faced legal repercussions after a data breach resulted in significant financial losses for customers.10

6) Increase in Hacker Expertise and Entry Points

- 74 percent of all breaches include the human element, with people being involved either via error, privilege misuse, use of stolen credentials or social engineering.11

- Example: A phishing email targeted at insurance brokers led to unauthorized access to sensitive client data, resulting in a data breach.12

7) Ongoing Nation-State Attacks

- The Department of the Treasury reported that the total value of U.S. ransomware incidents reached $886 million in 2021, a 68 percent increase compared to 2020.13

- Example: Health insurance and services company UnitedHealth Group is blaming a state-sponsored threat actor for a cyberattack on its subsidiary Change Healthcare.14

8) Remote and Hybrid Work Increased Attack Surfaces (not going away)

- CyberArk found 85 percent of organizations experienced a security incident due to remote work during the COVID-19 pandemic.15

- Example: A remote employee of an insurance brokerage accidentally exposed sensitive client data by using an unsecured Wi-Fi network.16

9) It’s not “If” a Breach Will Happen, it’s “When”

- The IBM Cost of a Data Breach Report states that the global average cost of a data breach in 2023 was USD $4.45 million, a 15 percent increase over three years.17

- Example: An Insurance consulting and brokerage firm is informing more than 1.5 million individuals that their personal information was stolen in an August 2023 cyberattack.18

Buckler’s Founder and Chairman, Vincent Guyaux states, “Cybersecurity, and the regulatory requirements around it, went from suggested to required and from attestations to evidence-based. Adhering to cybersecurity regulations isn’t just a legal necessity; it’s also essential for preserving the confidence of clients and stakeholders.”19

Brian Edelman of FCI adds, “Anyone that cares deeply about their business should care about cybersecurity. As an MSSP that automates and secures environments with Zero Trust solutions, we have seen it all from one and two-person agencies to large enterprises and brokerages that have a pressing need to stay compliant as threats continuously shift.”

Cybersecurity and compliance must be at the forefront of discussions and actions within the insurance world. The evolving threat landscape, coupled with regulatory pressures and the increasing reliance on technology, necessitates a proactive approach to cybersecurity. By understanding the top reasons why cybersecurity and compliance are important, insurance professionals can better protect themselves, their clients, and the integrity of the industry as a whole. It’s time to make cybersecurity and compliance front-burner topics and take decisive actions to safeguard against cyber threats in today’s digital age.

Data Encryption is the Foundation for a Compliance Program

Data encryption is the foundation to building out a solid, executable compliance program. Although, most compliance requirements only address minimal data encryption requirements such as encryption at rest and in transit, if they specifically define encryption at all. Many compliance regulations basically state that data must be protected. We have to remember that compliance refers to adhering to laws, regulations, and guidelines that dictate how an organization should manage and protect data. Data security, on the other hand, involves the technical and administrative controls used to protect data from authorized access, breaches and other forms of misuse.

So why is data encryption the foundation to building out a solid, executable compliance program? Let’s look at where compliance frameworks intersect data encryption:

- By encrypting private, sensitive, and controlled data in all three states (encryption at rest, in motion, and in use), the organization will position to exceed any compliance data security requirements and avoid compliance penalties. More importantly, encryption of data in all three states will greatly reduce the likelihood of a threat actor stealing or ransoming critical data. In 2022, Paperclip Inc. launched SAFE®, an innovative solution specifically designed to assure that critical data is always encrypted, including where organizations are most exposed, data in use.

- Alignment to defense in depth related compliance requirements. Compliance requirements mandate training, accessibility, authentication, and data leakage controls. Encrypting core, operational data will assure that all compliance layers from the data through to the endpoint are more effective. When implemented, the proper encryption solution will protect the data when other measures break down. For example, Paperclip SAFE®, a data in use encryption solution will protect sensitive data even when a threat actor compromises an end user’s credentials, or even when the threat actor is inside the network perimeter.

- One particular data compliance area currently being targeted by the SEC and FINRA is related to incident response (IR). On the surface, IR is less about data security and more about business continuity. Auditors are challenging not just the plan in place, but has it been tested. They want to see the results and mitigation reports based on performance of active IR tabletops. Where the audit of the IR plan intersects with data security is around how auditors are looking to see how the IR plan and tabletop connect to the security an organization has in place. For example, when the organization has encrypted critical data with a solution such as Paperclip SAFE®, it removes that data from theft and ransom. This practice reduces the likelihood of consumer data exposure and will allow the organization to quickly gain control of the incident. IR is all about regaining control of the operational environment, reducing threat actor activity, and getting the operation back online with little to no disruption.

A strategic combination of services from organizations like Buckler and Paperclip will avoid costly out of compliance penalties and even more costly breach expenses and catastrophic reputational loss.

Reference:

- https://www2.deloitte.com/us/en/pages/regulatory/articles/insurance-regulatory-outlook.html.

- https://www.dfs.ny.gov/reports_and_publications/press_releases/pr202311281.

- https://www.linkedin.com/pulse/rising-costs-data-breaches-2023-key-insights-from-ibms-latest/.

- https://www.csoonline.com/article/567833/equifax-data-breach-faq-what-happened-who-was-affected-what-was-the-impact.html.

- https://www.ibm.com/thought-leadership/institute-business-value/en-us/blog/security-fraud-risks-banking-financial-markets.

- https://money.cnn.com/2017/05/13/technology/ransomware-attack-nsa-microsoft/index.html.

- https://www.cfo.com/news/cybersecurity-attacks-generative-ai-security-ransom/692176/#:~:text=Seventy%2Dfive%20percent%20of%20security,Sapio%20Research%20and%20Deep%20Instinct.

- https://www.forbes.com/sites/forbestechcouncil/2024/01/23/deepfake-phishing-the-dangerous-new-face-of-cybercrime/?sh=3ecc5d774aed.

- https://cybersecurityventures.com/cybercrime-to-cost-the-world-9-trillion-annually-in-2024/.

- https://www.insurancejournal.com/news/national/2024/01/02/753570.htm.

- https://www.verizon.com/business/resources/reports/dbir/.

- https://www.cnbc.com/2023/01/07/phishing-attacks-are-increasing-and-getting-more-sophisticated.html.

- https://www.gao.gov/assets/870/865761.pdf.

- https://www.securityweek.com/state-sponsored-group-blamed-for-change-healthcare-breach/.

- https://www.cyberark.com/press/cyberark-state-of-remote-work-study-poor-security-habits-raise-questions-about-the-future-of-remote-work/.

- https://www.cpomagazine.com/cyber-security/protecting-remote-workers-against-the-perils-of-public-wi-fi/.

- https://www.ibm.com/reports/data-breach.

- https://www.securityweek.com/1-5-million-affected-by-data-breach-at-insurance-broker-keenan-associates/.

- https://www.linkedin.com/pulse/impact-cybersecurity-insurance-brokering-chathura-kehelpannala-jyayc/.

The Power Of Administrative Delegation: Offloading Admin Work To Focus On Growth

In the world of life insurance and brokerage, efficiency is king. Brokerage general agencies (BGAs) and insurance marketing organizations (IMOs) are the engines of growth in this sector, fueling the progress through strategic agent engagement and effective policy management. Yet, amidst the bustling activity of daily operations, the art of administrative delegation becomes a linchpin for sustainable expansion. The Power of Administrative Delegation is not just a matter of operational logistics; it’s a strategic imperative that can make the difference between stagnation and success.

Running a BGA or IMO necessitates a delicate balance of patience, perseverance, and diligent effort. It’s indisputable that the trajectory of your growth and profitability heavily relies on your ability to attract and retain agents and advisors. Any lapse in focus can inadvertently become the open door your competitors need to lure your agents away, and they won’t hesitate to do so.

Fostering business growth often takes a backseat to necessary and timely administrative responsibilities like agent contracting, meticulous data entry, application processing, case management, and managing complex commission structures. Although your agency’s foundation rests upon service principles, there’s often a lack of resources dedicated to fulfilling its needs. To delegate, or not to delegate? That is the question.

Roadblocks to Success: The Clock and The Work

While every aspect of the work your BGA or IMO performs is essential, the work that takes the most hours off the clock rarely brings in the most revenue.

Sometimes Scaling Up Requires Shipping Out

For any business to grow, it needs the ability and resources to focus on strategy, implementation, and execution. For every talented, knowledgeable, staff member who is buried under routine administrative tasks, the opportunity for them to execute growth strategies is sorely missed. So, what are your options?

Technology Can Only Take You So Far

Implementing new systems, CRMs, and other insurtech-facing platforms is essential to maximize your staff’s time and your firm’s overall efficiencies. What’s often an afterthought is how these systems still require training and ongoing maintenance. While artificial intelligence promises a future of robust technological solutions, it is currently relegated to use in other industries, such as marketing, content creation, and graphic design. The best way to enable your technology to be all it can be is with attention from an experienced support team.

While technologies can boost your productivity and organization, a critical element is still missing in any of these systems. Life insurance is very much a people-centric industry. It requires human capital and human touch-points to subsist at even the most basic level. Risk management is not something that people are happy to entrust to technology alone. This is an industry based on trust, integrity, and accountability. Of these three, trust might be the largest obstacle to a BGA or IMO…outsourcing busy work to a third party.

Envisioning Growth

Picture the enhanced productivity your business would achieve if your team could dedicate their time to crucial tasks like recruitment and retention, rather than grappling with complex commission structures.

Visualize the possibilities: Rather than scrambling for APSs and case status reports, imagine engaging with that large agency to assist them in providing comprehensive life solutions to their clients.

Consider the efficiency gained from eliminating repetitive data entry tasks. Instead, envision direct conversations with financial advisory firms, presenting their advisors with opportunities to safeguard their clients’ assets.

Imagine how much you could grow if you had more time and resources.

With Great Power…

There is great power in delegating, and with great power comes great responsibility. The ability to combine technology you can rely on with people you can trust is the solution that can help your business realize its potential. Technology is easily vetted, but people require track records with experience, expertise, and the capacity to take the busy work off your plate with accuracy and precision. They need to be able to point to their reputation in the industry and reveal a constant measure of success. There is one solution provider leading the way: Employee Pooling (EP) stands as a testament to this ethos, seamlessly blending technology with expert human capital within the insurance sector for over a decade. Tailored to address the challenges confronting expanding BGAs and IMOs nearing capacity limits, EP offers end-to-end services and solutions from submission to commission, earning the trust of numerous agencies nationwide, regardless of size. You can learn more about Employee Pooling by visiting https://employeepooling.com.

Delegation is not just about offloading tasks; it’s about creating a space where strategic thinking and growth activities can flourish. When administrative duties are streamlined, and the right tasks are assigned to the right people or systems, the entire organization can breathe easier and focus on what truly matters: Building relationships, developing new markets, and crafting policies that serve the community better. By embracing delegation, BGAs and IMOs can pivot from being transaction-focused to being growth-oriented, shifting their gaze from the minutiae to the big picture.

The benefits of such a shift are manifold. Agencies can experience a boost in productivity, allowing for a more profound engagement with current clients and the pursuit of new opportunities. Yes, what I mean is expanding more channels to offer products and services. You can exponentially grow the production from financial advisors and P&C agents for example. Moreover, sales and marketing can take center stage for BGAs and IMOs.

However, with the power of delegation comes the need for discernment. It is not merely about assigning tasks; it is about empowering a reliable team that can handle these tasks with the same level of care and commitment as the core members of the organization. This team, whether in-house or outsourced, must be adept at navigating the intricacies of insurance administration and possess a deep understanding of the industry’s regulatory landscape.

Look, the life insurance industry is changing because of technology, market, and driven by a new generation of agents and consumers. The power of administrative delegation is transformative, allowing BGAs and IMOs to scale new heights and achieve unprecedented growth. By effectively managing and offloading admin work, these organizations can concentrate on cultivating their core competencies and capitalizing on growth opportunities. It is the fusion of robust technology with the expertise of seasoned professionals that forms the bedrock of a thriving insurance agency. As the sector continues to evolve, those who master the balance between technological efficiency and human insight will lead the charge into a future where growth is not just an objective but an ongoing reality.

In this landscape, brokerage general agencies and insurance marketing organizations that recognize and act upon the value of administrative delegation will not only survive but thrive, transforming challenges into catalysts for growth and setting new standards of excellence in the insurance industry.