For all of us in financial services and those that plan on being around for the next several years, there are great reasons to be excited. I believe there will be more millionaires created in our industry over the next couple of decades than ever before. This is because of the supply and demand dynamics that will be taking place. There will be higher demand for our services while, at the same time, there will likely be lower supply of your competitors. Allow me to explain.

First, let’s discuss demand. Without boring you with a ton of the statistics that we all have heard numerous times, I think it is obvious that the demand for our services will continue to skyrocket. Over the next 10 years the entire Baby Boomer cohort—who own over 50 percent of the wealth in our country—would have reached retirement age. For purposes of this article, I will define retirement age as age 65.

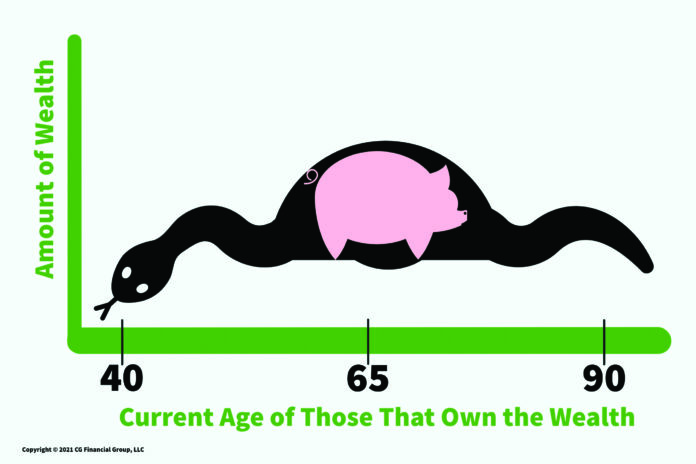

Some of you have heard of “the pig through the python” when it comes to the wealth approaching retirement age. I like the analogy of “the pig through the python” because it is a great visual representation of the massive amount of baby boomer wealth working its way through the system. I don’t want to get too graphic in discussing a python’s digestive tract, but my drawing depicts a pig that had been eaten by a snake decades ago. That pig that is now in the python represents the massive amount of wealth owned by the baby boomer cohort that is now “digesting” its way to age 65. The entire pig is going to be fully digested over the next 10 years, with the youngest baby boomer hitting age 65 in the year 2029.

Clearly what this “pig in the python” means is a continued increase in demand. This means that baby boomers will need their retirement plan set up very soon, if they have not done so already. Furthermore, the baby-boomer opportunity is not over once the entire pig passes retirement age. This is because the later phase of their retirement will potentially present “long term care events” that also need to be planned for, if it has not been done already. Lastly, after the pig passes the retirement age and the long term care ages, the cycle is still not complete. The final part will represent the passing of that wealth to the next generation—estate planning.

What I just explained was the three-legged stool of planning opportunities that will only increase over the coming years: 1. Retirement planning. 2. Long term care planning. 3. Estate planning. If you do not represent all of these three opportunities, I would encourage you to take a more holistic approach, because the “pig in the python” needs your services.

What about my reference to the “supply” of your competitors? Although exact statistics are hard to come by, it is no secret that the average age of the independent insurance agency owner is somewhere between 58 and 61. Meaning, they are a part of the pig in the python that will be retiring over the next decade as well. This void in supply is what our industry really needs to figure out quickly because the agent attrition is already happening. However, this void will leave great opportunities for those of you that continue to stick around.

In short, there is a huge tidal wave of money that is coming the direction of you and your competitors right now. But many of your competitors are not going to be around in 10 years, leaving you to fill this void in supply.

My thoughts on how financial professionals can address the Pig through the Python:

1) Be holistic: particularly in the three areas that I previously mentioned. If you choose not to master any one of those areas mentioned, partner with somebody that can assist in that area

2) Be a student of the business: As Daniel Pink says, it used to be “buyer beware” but now it is “seller beware.“ Meaning, if you give a potential buyer a couple hours of web access, they can learn more about a particular product or solution than what many agents knew 30 years ago. If you are not as savvy with retirement planning, long term care planning and estate planning as the client is—beware. Read a lot, join webinars, subscribe to top publications like Broker World, and partner with the right GAs or IMOs that will allow you to be a “student.”

3) Educate and they will come: I often tell the story about when I was straight out of college (over 20 years ago) and went to work with a big career agency. The sales training that we received at the time was what I would consider slightly abrasive to the consumers. The theme of the training was something like this: “You should get the prospect uncomfortable, close them in one meeting with a powerful assumptive closing statement, wait for them to respond, and then the first one to respond loses.” And by the way, many times those “prospects” were your friends or family that they effectively forced you to contact as soon as you joined them.

My point is—related to my second point—times have changed and these tactics do not work (if they ever did). Frankly, I never followed those tactics to begin with.

Unfortunately many consumers today have biases against what we do and will immediately react negatively if you take the “hard-close” approach. Consumers today choose to be educated versus being hard closed. And turning a prospect into a client is a longer process than it once was.

How do you educate? First off, you be a student of the business as I suggest in #2. But you also need to leverage technology to drip the education to your consumers so that you are the one providing them with the best information versus Google. They will buy eventually if you do this effectively.

Tools for this “drip” educational process are:

- Your website. Have a Blog where you post educational content.

- Create an email distribution list of prospects that sign up for your blogpost emails. I like Constant Contact and MailChimp for email providers.

- Facebook Business Page: This is free! Add your comments to it every week. You will find that your personal “friends” on Facebook will gradually subscribe to your Business Facebook page, without you ever “soliciting” them. Free marketing…

- Email timely articles to your existing prospects with your summary of why you liked that article and why it made you think of sending that article to them.

- Do Virtual Seminars. This is one of the few positive things that the COVID crisis left us with. Consumers are willing to join “virtual seminars” more than they used to.

4) If you are independent, market the advantages: I have observed that many agencies that are independent do not market the “independence” enough to their consumers. Rather, some financial professionals view the lack of a big brand behind them as being a detriment. I beg to differ, and here is an example:

I ran a term quote on me—a 43-year-old healthy male—needing $1 million. The difference between the lowest priced term policy and the highest priced term policy on my list of carriers is about 80 percent. Meaning, the most expensive product is 80 percent higher in price than the cheapest. Imagine if I was tied to only one company and that one company was the most expensive?

Although “cost is an issue only in the absence of value,” my simple example does demonstrate the capabilities that independent agents have when it comes to helping their clients. Choice is freedom, and you should market that freedom.

5) You can be independent but don’t be alone: If the educational content and the ability to do everything that I mention above are something that seems intimidating to you, partner with the right people! This is where a good IMO comes into play and will make all of the above (education, tools, technology, marketing, etc.) a simple process. Afterall, this is what IMOs do…

6) Last! It was the legendary insurance professional—John Savage—that said, “One of the secrets to life insurance success is to last.” Sounds simple, huh? To merely last? That sounds very superficial, but I believe it is true and I believe that if you can “last” throughout your first couple of years, things really start to happen.

If you are just entering this business, know that the first couple of years is indeed tough. However, I believe there is something special about the 18 months to two-year mark. I believe there a few things that happen around that point:

- I believe that there is something psychological in our prospects’ minds that triggers after you have been in the business for around 18 months to two years. A lot like how in marketing they say that it takes seven views of an ad before a consumer acts, I believe that the magical point where you become more credible to consumers is 18 months to two years in. Of course, all of this depends on your particular skill set and assumes that you are doing the right things.

- This is a point where you have learned a lot from your mistakes and are finding that you are getting more effective at many things: Time management, prospecting, speaking, connecting, networking, product, etc.

- This is also point where your educational and marketing efforts that I previously mentioned (in #3) are starting to bear fruit.

I have heard it over and over again, “Man, after around the two-year mark I really started to make some money in this business.” Last!