This article is a bit of a preface to an article I have coming out next month that explores various systematic withdrawal strategies versus GLWBs. Without letting the cat out of the bag, I wanted to write this first because this will be an article that I can reference back to on a topic that is front and center in the conversation of systematic withdrawal strategies—Sequence of Returns Risk. If one does not understand sequence of returns risk, then my next article will likely be lost on them. Now, even if you are one that knows what sequence of returns risk is (as many agents do), then this article will still be useful to you as I show examples of how I articulate it to consumers.

But first, Mount Everest!

It is the crown jewel of mountain climbing achievements. It’s almost six miles high. I have read statistics that say that if you were to go directly from sea level to the top of Mount Everest without acclimating yourself gradually, you would be dead in a matter of minutes because of how thin the air is. The summit is the ultimate achievement for mountain climbers. However, a sizable portion of people that died climbing Mount Everest died after they hit the summit. Clearly, when you make it to the summit that does not mean the battle is over.

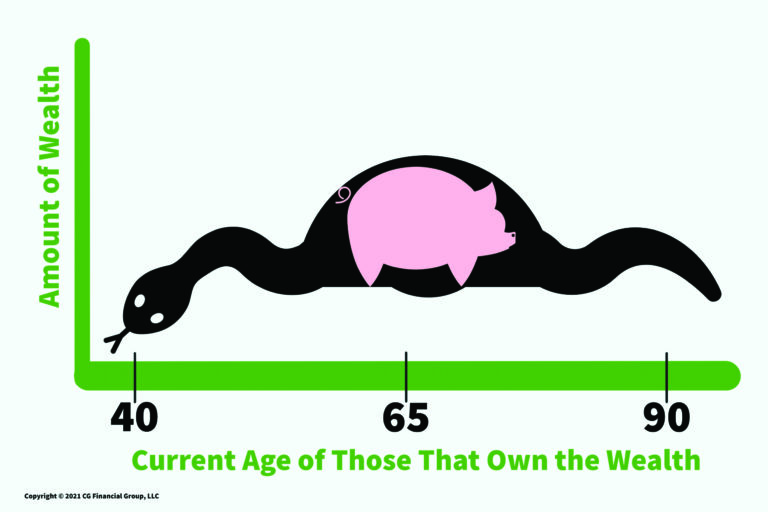

I have quite a few personal clients and I also conduct joint client calls with the agents of CG Financial Group. So, I talk to scores of pre-retirees per week and what I have found is this: Sometimes their goal is to hit the rhetorical “summit” of retirement. That is, to retire with X dollars and then it is smooth sailing from there. However, as most of us know, in the pre-retirement years you are not subject to things like sequence of returns risk and long term care risk. In the post retirement years—after hitting the summit—you are exposed to these new risks which makes the downhill trek from the summit much more treacherous. Just because a “financial advisor“ did an excellent job getting one up the hill, doesn’t mean they are fit for helping one with the trek back down. The calculus can be much tougher as you are making the trek back down the hill. Of course, what I am referring to with the “trek back down the hill“ is the post-retirement/decumulation years.

How I explain Sequence of Returns Risk

Let’s quickly discuss how simple the trek up Mount Everest is versus the trek back down the hill. From the beginning of 2000 to the beginning of 2020 the S&P 500 averaged 4.02 percent from a compound average growth rate (CAGR) standpoint. Furthermore, from a standpoint of just “simple averages“ the S&P 500 averaged 5.6 percent over that period. What this means is, without any withdrawals being taken out, if you put in $100,000 at the beginning you would have $219,862 at the end. And whether you got the returns in true sequential order from 2000 to 2020 or received those returns in reverse order from 2020 to 2000, the result would’ve been the same, $219,862. If you had a magic crystal ball at the beginning of the 20-year period and it told you that you would average 4.02 percent, you would have ended with $219,862, period!

Oftentimes after stating the above I will then ask consumers if they would have felt comfortable taking inflation-adjusted income of $4000—or four percent—each year out of their portfolio for the rest of their lives, given the return numbers I just laid out. A large majority of them state they would be comfortable doing that and comfortable that they would not run out of money over a 30-year retirement. After all, if the “simple average“ was 5.6 percent over that period, then taking out only four percent (initially) seems doable, right? Wrong! Simple averages lie especially when you have sequence of returns risk.

In short, in the pre-retirement years that crystal ball may work very well—even though it obviously doesn’t exist. Some folks believe they have the crystal ball. Remember Gordan Gekko? Furthermore, sometimes the “crystal ball” is quoting the past like “since 1926 the S&P 500 has averaged 10 percent per year.”

That “average return” of 10 percent is indeed true on the S&P 500. But in the post-retirement years, even if you do wholeheartedly believe that will continue, you might as well throw that crystal ball away unless it can also tell you in what order those returns are going to come. This is because of the impact of withdrawal‘s getting you into a death spiral if you were to have a poor “sequence of returns.”

A quick example of “Poor Sequence of Returns”

From the $100,000 portfolio at retirement, let’s assume that we will withdraw $4,000 initially and then add/subtract the growth of the S&P 500 for the next year, and then take another withdrawal at the beginning of the following year. The $4,000 will be increased by three percent (Hypothetical Inflation) every year from the beginning of 2000 to the beginning of 2020. With this true sequence from 2000 to 2020, our client would have run out of money in the 18th year even after getting a “Simple Average Return” of 5.6 percent. Unfortunately, many consumers experienced this “sequence” firsthand.

Conversely, if you reversed those returns and experienced the exact same returns, just in reverse order, how would you have turned out? Going backwards from 2020 to 2000 would have done very well for the consumers with an ending balance still being $107,741. So, the question is, did the crystal ball also tell you which scenario you would actually experience? Will it be 2000—2020 or 2020—2000? The crystal ball is useless here…

To summarize, in post-retirement, even if our financial advisor/crystal ball is 100 percent correct when they tell you that you are going to get X-percent per year on “average,” you might as well throw that crystal ball away unless it can also tell you what the “sequence of returns” will be.

A Quick Note on Inflation

Like how insurance policies can come with “riders,” I view the sequence of returns risk as having a little rider attached to it in a negative way. It has to do with the elephant in the room—the recent inflation that we have been experiencing. “Sequence of inflation” is the risk that piggybacks on sequence of returns risk. Many consumers are retiring today or retired last year and are finding that their first year in retirement is much more expensive than what they assumed! In other words, many of the retirement income models assume a three percent inflation rate that elevates the withdrawal amount as time goes by, as we have discussed thus far. But now consumers are having to take a withdrawal that is four percent higher than what they had originally prognosticated. That’s right, inflation from December 2020 to December of 2021 has been seven percent! To be clear, this does not mean that the retiree’s portfolio “drawdown” is increased by four percent. It means the inflation adjustment on the income is increased this year to seven percent. What kind of an impact does this have in our “sequence of returns” scenario?

If I assume that the withdrawal that started out at $4,000 increases by seven percent the following year (year two) then six percent, then five percent, then four percent, then three percent (for the remainder), following are the results. (Reminder, this is in contrast to the three percent flat inflation that we have been assuming throughout this article.)

Good Sequence of Returns (2020-2000)

The ending portfolio (S&P 500) balance is $98,109 versus the $107,741 number we would get if we only used three percent level inflation.

Bad Sequence of Returns (2000-2020)

The year in which you would run out of money with the “tapered seven percent inflation” is in year sixteen—versus year 18.

Although shaving two years off a portfolio because of sequence of inflation risk may not seem drastic, I would argue that if a retiree were actually living out this scenario (which many will), two years is precious lost time! This is yet another risk that financial professionals should collaborate with their clients to address.